How Does Fema Work If You Don T Have Flood Insurance

You can get.

How does fema work if you don t have flood insurance. Private flood insurance is sometimes available as a base policy as an. If you have not do so right away. If you have no flood insurance fema s ihp grant will help you in a specific set of ways after a flood or other disaster. Flood mapping is an important part of the national flood insurance program nfip as it is the basis of the nfip regulations and flood insurance requirements.

If you need help finding a provider go to floodsmart gov find or call the nfip at 877 336 2627. If you don t have flood insurance you can still find a safety net. This insurance is designed to provide an alternative to disaster assistance to meet the escalating costs of repairing flood damage to buildings and their contents. You may be able to buy flood insurance through a private company.

Government provides grants through the federal emergency management agency fema and loans through the small business administration sba to help you get back on your feet. Fema flood insurance isn t the only option. But if you do need protection don t procrastinate. But the fact is that homeowners without coverage are impacted by flood events every single day.

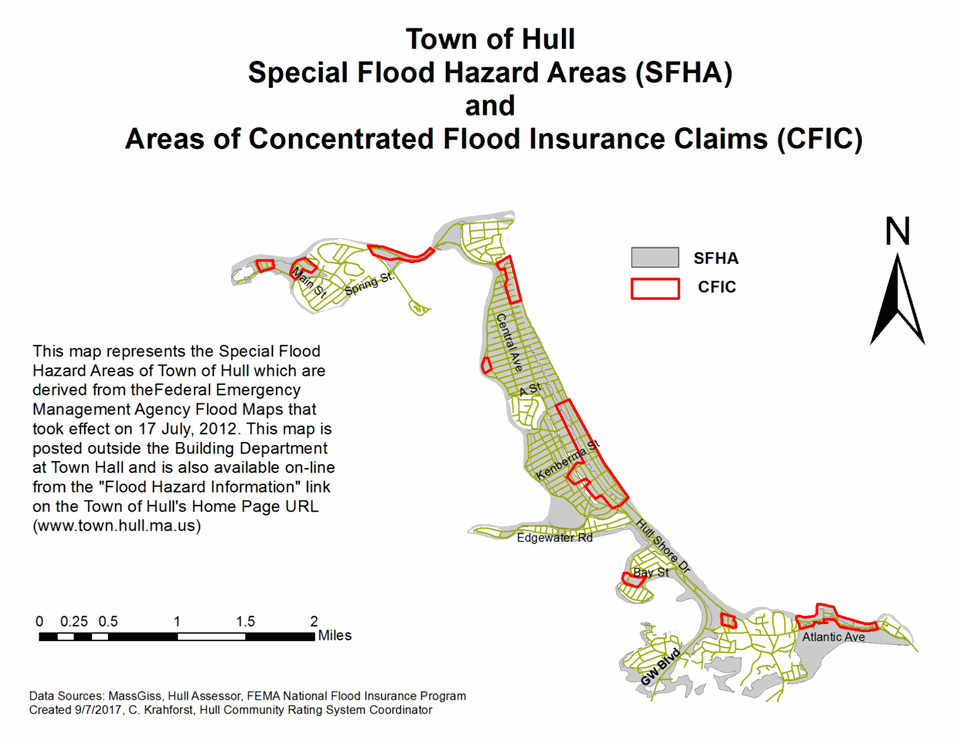

And don t place all of your eggs in the fema basket. Fema maintains and updates data through flood maps and risk assessments. Insurance does not cover many expenses so disaster programs may be able to help. Comprehensive car insurance an optional coverage pays for flood damage to a vehicle.

While only about 3 000 of the 1 8 million insured floridians have opted for the private route by. Fema does not duplicate any benefits so if you re covered under flood insurance you either get one or the other says brach. If you re already covered by a home insurance policy or a national flood insurance program nfip policy don t expect to receive double the coverage by registering for the individual assistance program as well. Don t rely on your homeowners or renters insurance because that won t cover it.

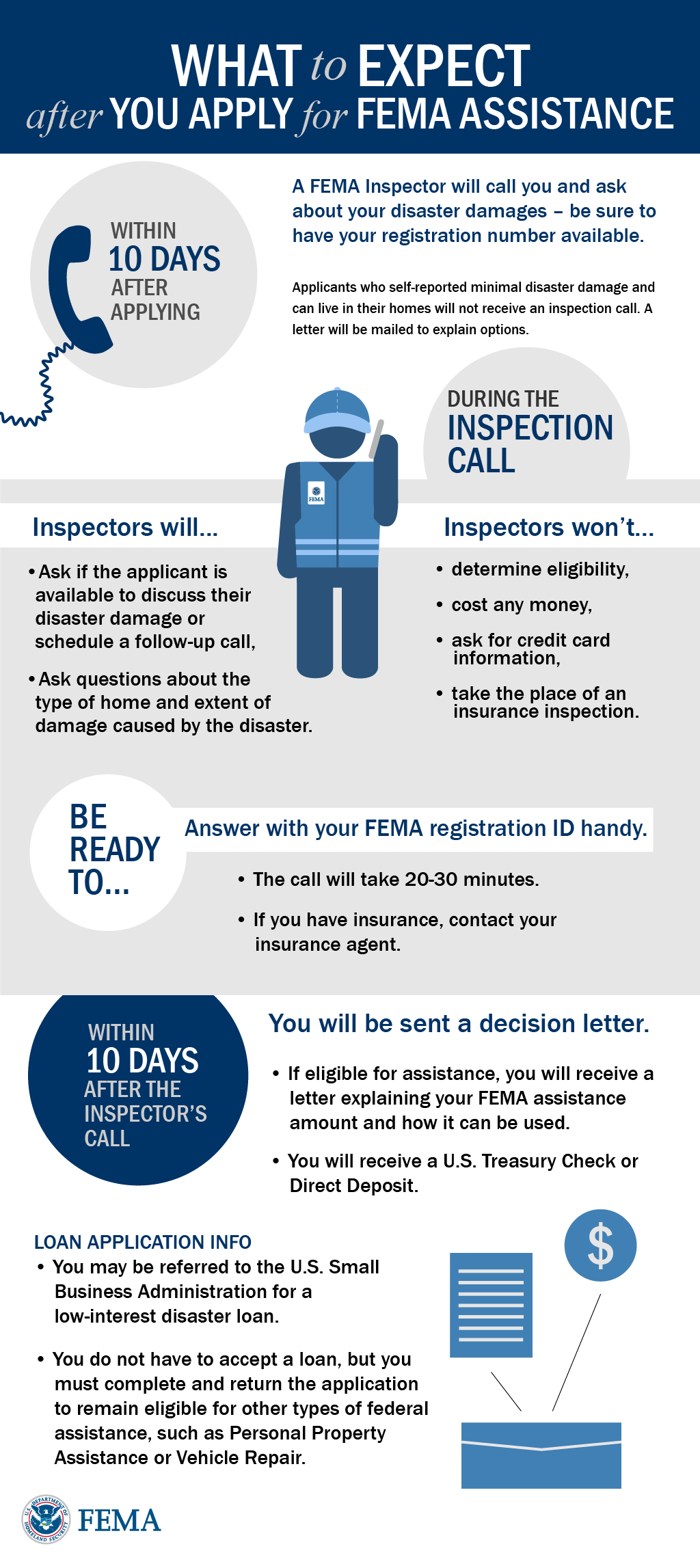

Plan ahead as there is typically a 30 day waiting period for an nfip policy to go into effect unless the coverage is mandated it is purchased as required by a. So you should apply for assistance even if you have insurance if you have unmet needs that fema may find to be eligible. If you have purchased only the minimum liability insurance required by your state you don t have coverage. Also you should not wait for your insurance settlement to apply for a low interest disaster loan from the.

Federal emergency management agency fema enables homeowners business owners and renters in participating communities to purchase federally backed flood insurance. Fema s flood mapping program is called risk mapping assessment and planning or risk map.