How Does Filing Chapter 7 Bankruptcy Work

In fact filing for bankruptcy can wipe out most nonpriority unsecured debts other than school loans.

How does filing chapter 7 bankruptcy work. A chapter 7 bankruptcy can remain on your credit report for up to 10 years. How quickly your debt will get wiped out will depend on the chapter you file. Learn more in your debt in chapter 7 bankruptcy chapter 13 bankruptcy. Under this type of bankruptcy you ll be required to allow a federal court trustee to supervise the sale of any assets that aren t exempt cars work related tools and basic household furnishings may.

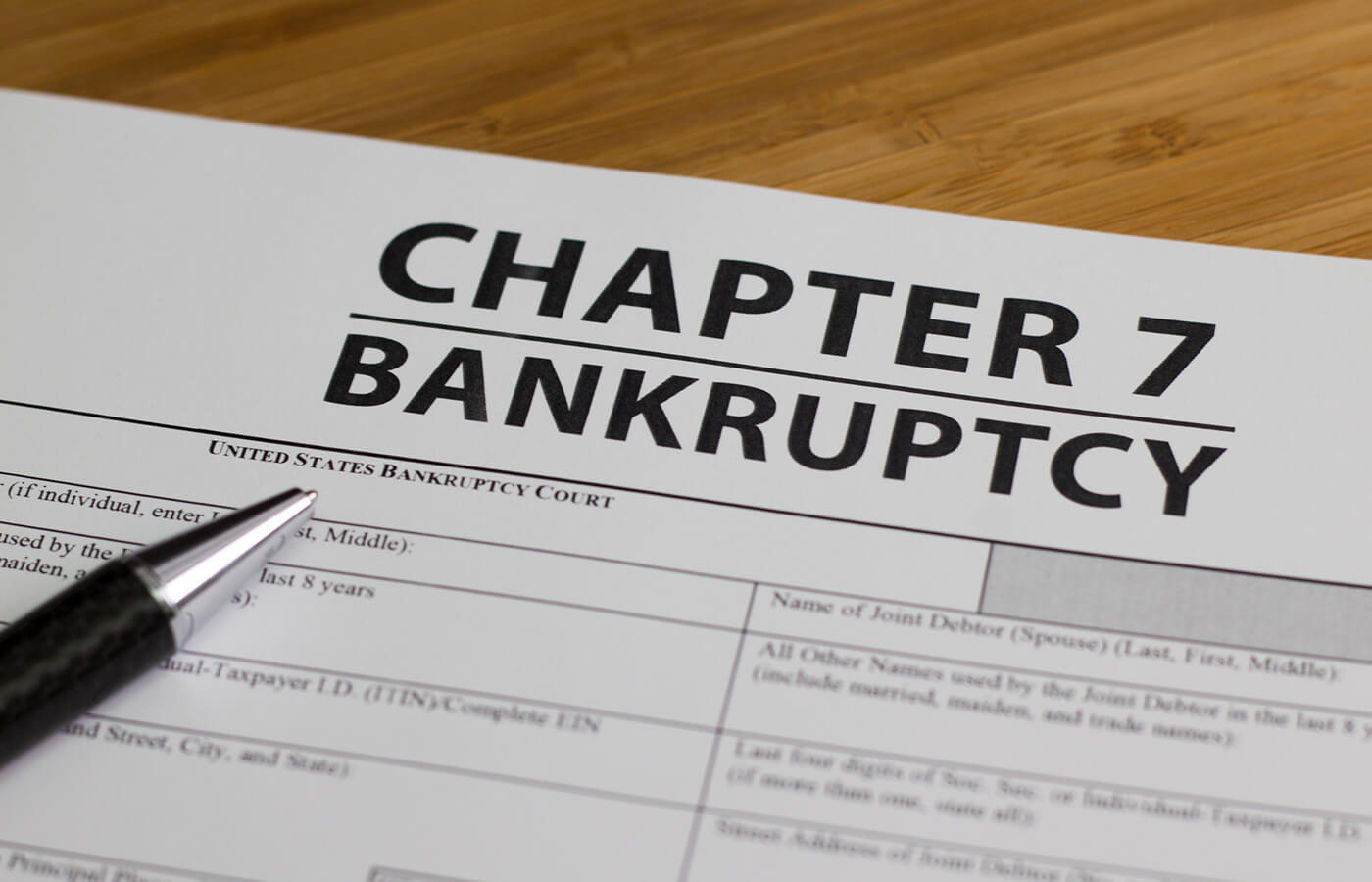

There are several types of bankruptcy for which individuals or married couples can file the most common being chapter 7 and chapter 13. Although a bankruptcy stays on your record for years the time to complete the bankruptcy process under chapter 7 from filing to relief from debt takes only about 3 6 months. Instead the bankruptcy trustee gathers and sells the debtor s nonexempt assets and uses the proceeds of such assets to pay holders of claims creditors in accordance with the provisions of the bankruptcy code. The chapter 7 petition and filing requirements.

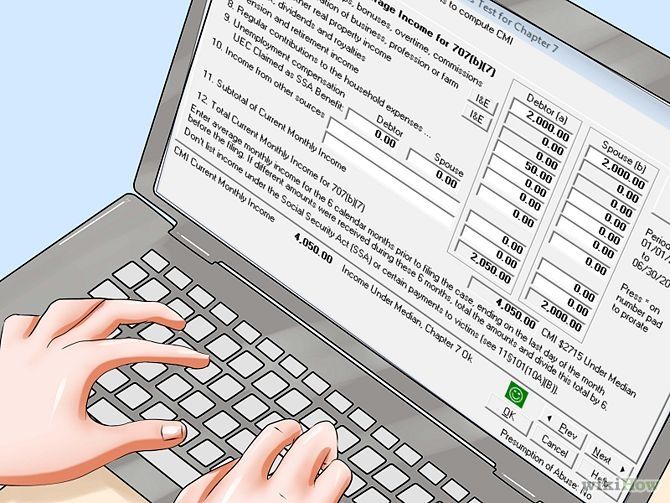

This chapter takes an average of three to four months to complete. A chapter 7 case begins with the debtor filing a petition with the bankruptcy court the court serving the area where the individual lives or where the business debtor is organized or has its principal place of business or principal assets. Advantages of chapter 7. If you re far behind on your bills and don t have the means to afford monthly payments and living expenses filing chapter 7 bankruptcy could be a last resort to help you reset your finances.

Chapter 7 bankruptcy also known as straight bankruptcy is what most people probably think of when they re considering filing for bankruptcy. A chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Updated 2020 upsolve is a nonprofit tool that helps you file bankruptcy for free. Bankruptcy will ruin your credit for some time to come.

Disadvantages of chapter 7. It is also the most popular form of bankruptcy making up 63 of individual bankruptcy cases. Chapter 7 bankruptcy also known as a straight or liquidation bankruptcy is a type of bankruptcy that can clear away many types of unsecured debts. Will filing for chapter 7 bankruptcy affect my spouse.

Think turbotax for bankruptcy. Chapter 7 bankruptcy is generally the best option for those with a low income and few assets. Following is an overview of the early course of a typical chapter 7 bankruptcy case. The goal of a chapter 7 debtor is to obtain an order of discharge.

A trustee is an individual that is assigned to review administer and evaluate your case to determine whether you meet the chapter 7 bankruptcy law requirements entitling you to a discharge. The individual filing any bankruptcy case is called a debtor.

:max_bytes(150000):strip_icc()/WhatYouNeedtoKnowAboutBankruptcy_fixed-cce9d8e9ff5f4141a9df65acb370858c.png)