How Does Harp Refinancing Work

The program started on april 1 2009 and ended on december 31 2018.

How does harp refinancing work. Refinancing works by giving a homeowner access to a new mortgage loan which replaces the existing one. If you elect to roll these costs into your new refinanced loan this can increase your new monthly payments. So under harp 2 0 it was possible to qualify for a refinance loan with a ltv ratio above 125. One of our mortgage professionals will help you understand how refinancing could benefit you.

Harp allows homeowners to refinance their mortgages even when they owe more than their houses are worth. Unlike harp 1 0 the updated version of the program had no ltv ceiling for individuals with fixed rate mortgages. How does harp work. Second many people refinance in order to obtain money for large purchases such as cars or to reduce credit card debt.

A home equity line of credit is calculated as follows. How to refinance a mortgage. How does refinancing work. How does harp 2 0 work.

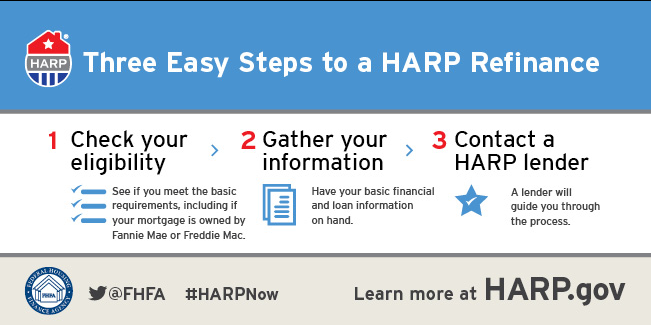

The way they do this is by refinancing for the purpose of taking equity out of the home. As your mortgage company we already have most of the information we need on file and can help you refinance your home as quickly and easily as possible. A harp loan is short hand for the home affordable refinance program that was created after the 2008 mortgage crisis by the federal housing finance agency fhfa. How much does it cost to refinance.

If you qualify for harp refinancing you may be able to save a significant amount of money by lowering your monthly payment reducing your interest rate switching from an adjustable rate mortgage to a fixed rate mortgage or shortening your mortgage term from 30 years to 15 or 20 years. On a 250 000 loan for example refinance closing costs might be 5 000 15 000. If you re a homeowner and have questions about whether you qualify for a loan modification or refinancing under harp 2 0 contact the homeowner s hope hotline at 1 888 995 hope or go to. First the home is appraised.

Contact us today for help. The program was revised recently to increase the number of borrowers who can participate. Typical mortgage refinance closing costs can range from 2 to 6 of the loan s principal. The details of the new mortgage loan can be customized by the.