I Haven T Paid Tax For 10 Years

Thus depending on your specific tax situation the irs could have as long as 16 years to collect your tax debt.

I haven t paid tax for 10 years. If you ve been working normal w2 jobs as opposed to 1099 or under the table then your taxes have likely been withheld by your employer and your income info has already been transmitted. These are two hugely different situations. If you owe back taxes from 10 years ago or longer you might feel you are safe from the long arm of the irs collection department. How are you going to avoid tax problems in the future.

Here are a few reasons why the statute of limitations for the irs may go beyond the standard ten year rule. The irs receives copies of any w 2 forms or 1099 forms that are issued to you each year. Perhaps there was a death in the family or you suffered a serious illness. The report looks at the first year since the tax cuts and jobs act of.

Before you panic let s take a look at what could actually happen and how you can mitigate the chances of the worst of. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an h r block or block advisors office and paid for that tax preparation. Before april 15 2020 you will receive tax refunds for the years 2016 2017 2018 and 2019 if you are entitled to them. Not filing taxes for several years could have serious repercussions.

Referred client must have taxes prepared by 4 10 2018. That would be an inaccurate assumption and one that could cost you dearly. Understanding the collection extension the 10 year statute of limitations for tax collection isn t set in stone and certain events can extend the amount of time the irs has to collect from you. I think you need to clarify whether you definitively haven t paid taxes or if you ve simply not filed tax returns.

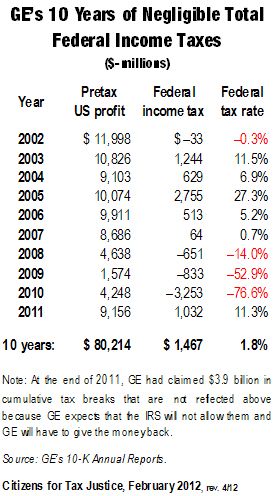

Whatever the reason once you haven t filed for several years it can be tempting to continue letting it go. Not only can the irs stop you from applying for a passport or a mortgage but they can also create a s ubstitute for return against you charge you for failure to pay or charge you for failure to file. Nearly 100 companies in the fortune 500 had an effective federal tax rate of 0 or less in 2018 according to a new report. People may get behind on their taxes unintentionally.

Referring client will receive a 20 gift card for each valid new client referred limit two. Hello g7 in a situation where a taxpayer as not filed a return in a number of years the irs requires that you go back and file a return for the previous 6 tax years in 99 of the cases that would be as far back as you need to go. However not filing taxes for 10 years or more exposes you to steep penalties and a potential prison term.