How Does A Life Insurance Policy Work After Someone Dies

Two weeks after death secure certified copies of death certificates.

How does a life insurance policy work after someone dies. Most standard life insurance policies are paid within 30 to 60 days of the claim. This is usually when the insurer needs to carry out some level of investigation into the death. Permanent life insurance policies also have cash values associated with them that can be. The life insurance payout.

These are the most commonly known life insurance policies. How long does it take to get life insurance money after a death. There are three basic types under this policy. These are good for one person who ll get the benefits when the insured dies.

The insurance company investigates the claim and then pays out the death benefit. Life insurance benefits are typically paid within 30 to 60 days of the filing of a claim but delays can arise if the insured dies within the first two years of the issuance of a policy for. Also inquire about whether there is a company wide life insurance policy. Especially if survivors depended on the deceased person for financial support they may need to quickly get cash for urgent ongoing expenses such.

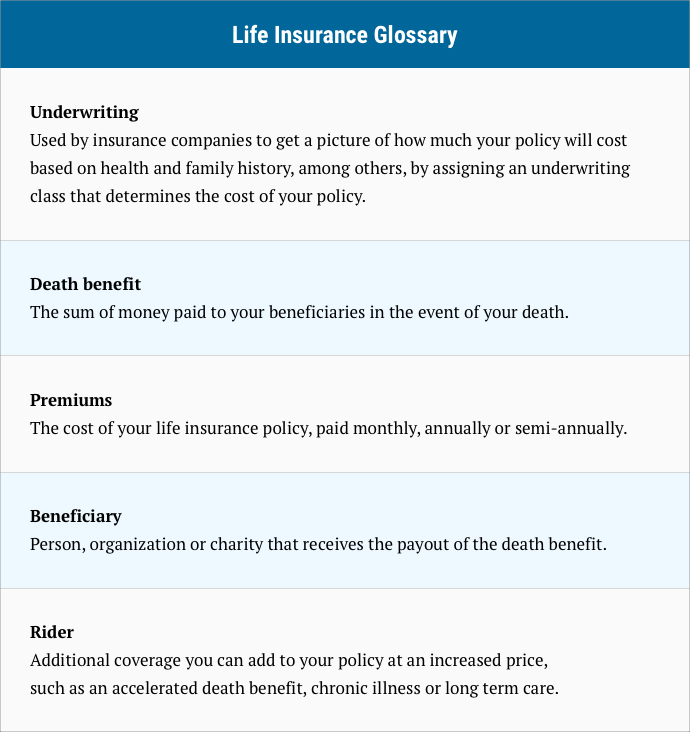

Life insurance policies pay out a death benefit upon the insured s death to their named beneficiaries. There are some circumstances where the length of time could be longer. Any interest earned by the proceeds would be taxable however if the policy earns income after the date of death. You re going to need death certificates to close bank and brokerage accounts to file insurance claims and to register the death with government agencies among other things.

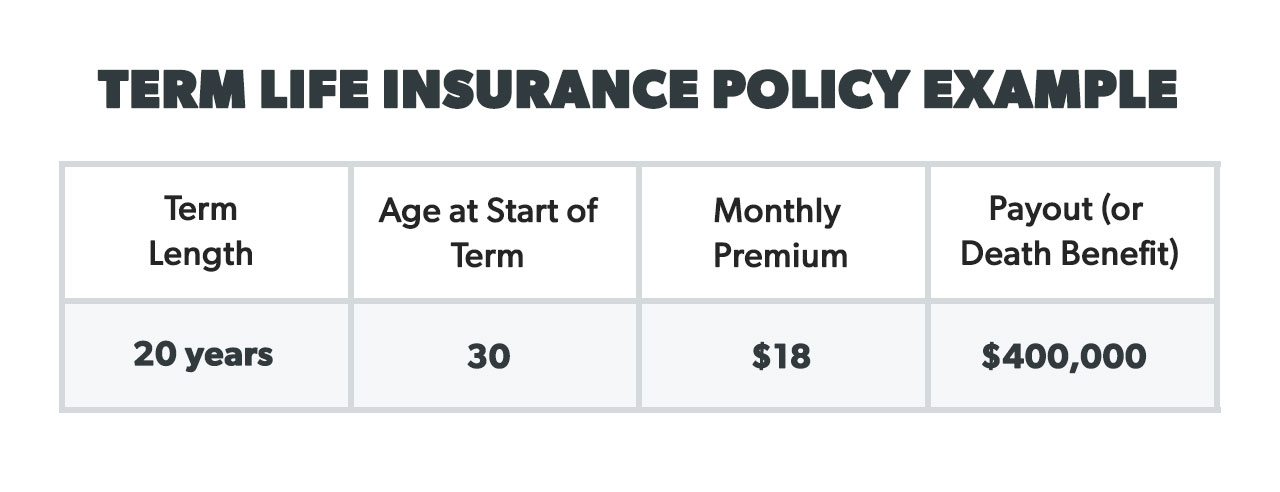

The internal revenue service doesn t consider death benefits to be income. The beneficiary submits the death certificate to the insurance company. Term life also known as pure life insurance term life lets the beneficiary claim the life insurance payout within a defined term from one to 30 years. You don t have to pay income tax on the initial policy proceeds when you re the beneficiary of a life insurance policy.

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)