How Does Loan Forgiveness Work Ppp

Prior to the change the owner employee compensation rule stated that anyone with a stake in a company no matter how small that took out a ppp loan was eligible for forgiveness of the lesser.

How does loan forgiveness work ppp. Schedule a p 6 1. Independent contractors have the ability to apply for a ppp loan on their own so they do not count for purposes of a borrower s ppp loan forgiveness. Schedule a worksheet p 9 1. It has been fast tracked through congress and the financial system so it reaches businesses desperate for relief.

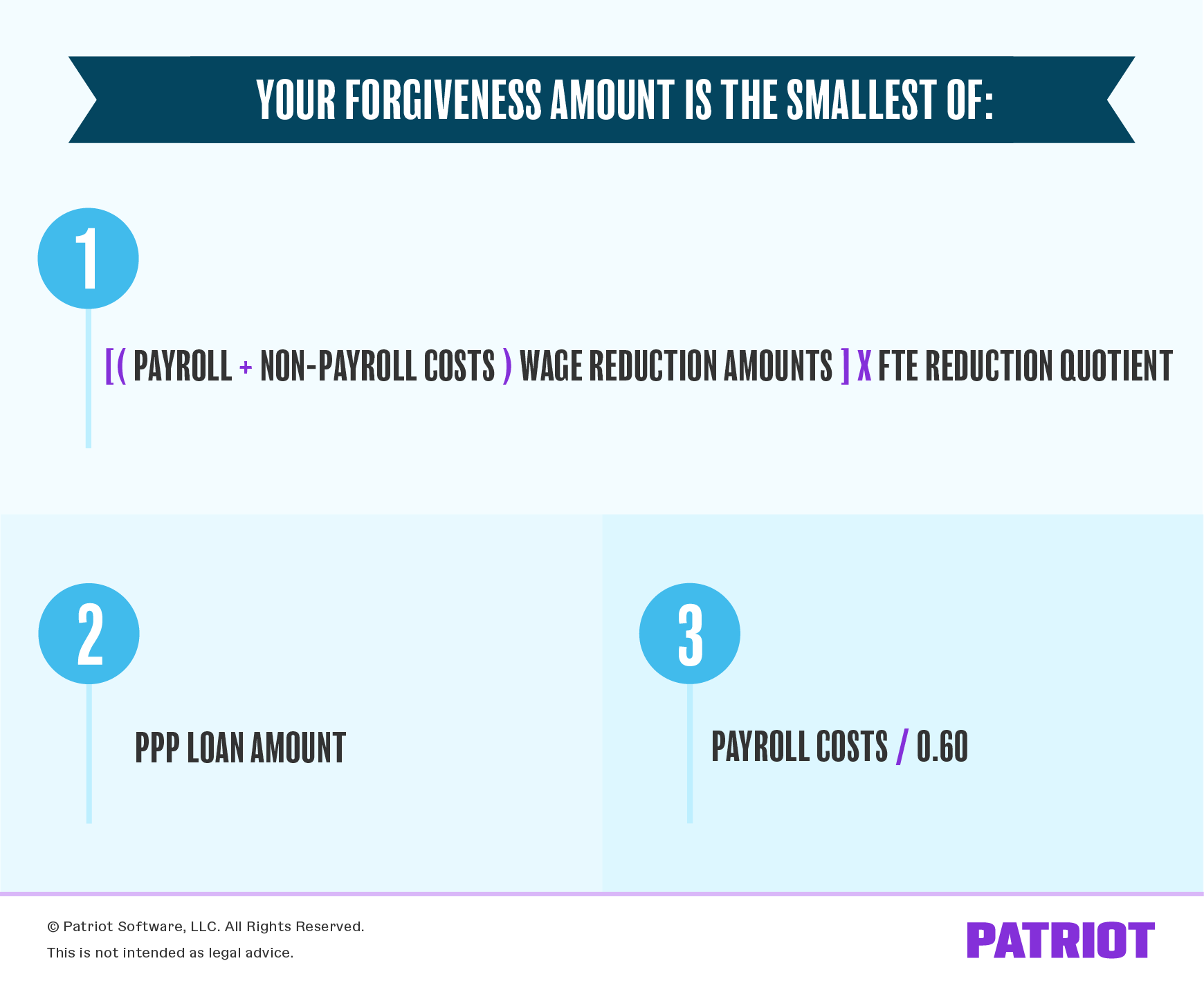

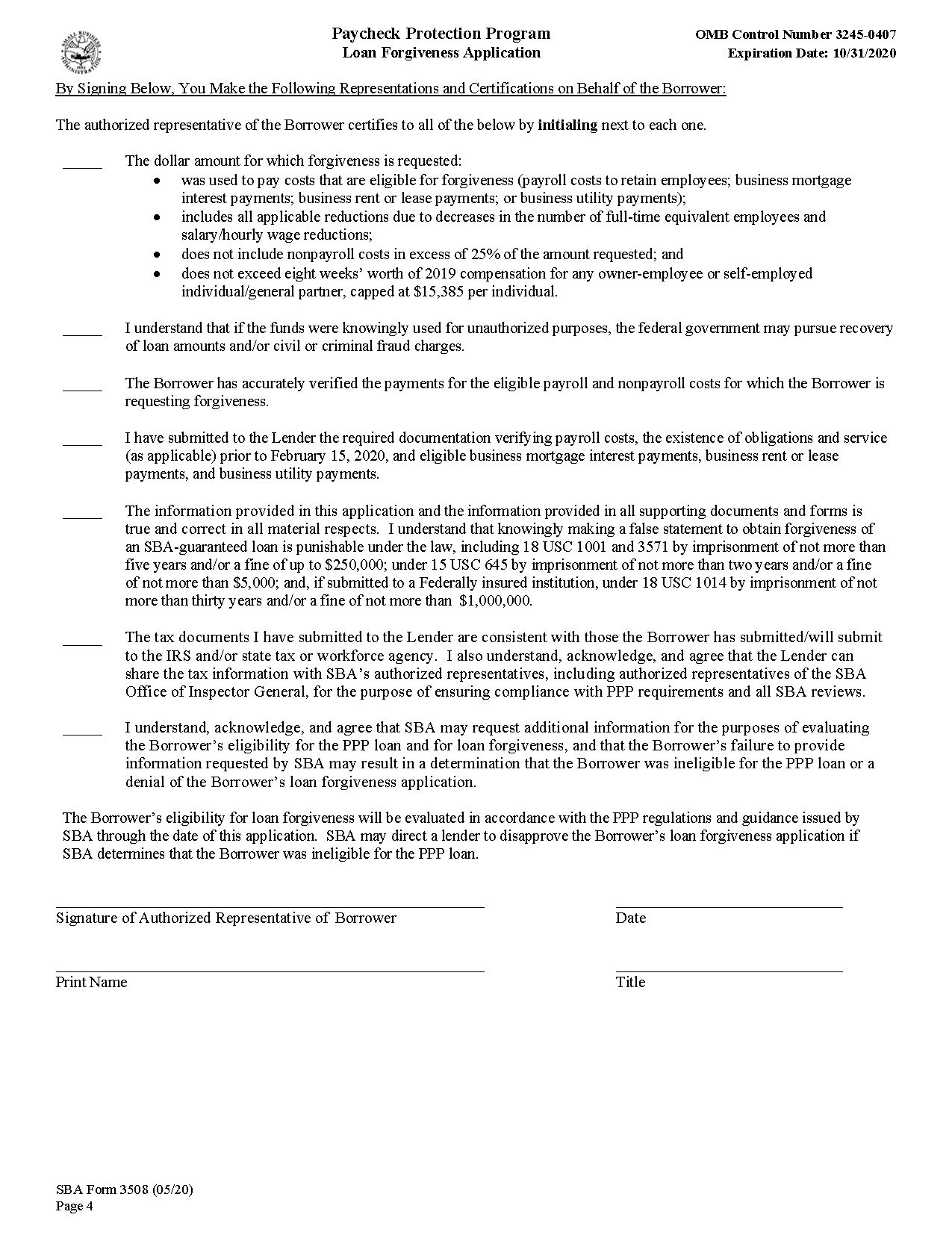

How does ppp loan forgiveness affect a tax credit. Ppp forgiveness application and attestation pp 3 4 1. Application instructions pp 1 2 2. The three steps that based on currently known information give you the best chance of maximum perhaps even 100 payroll protection program ppp loan forgiveness according to the expert.

You cannot get both a small business loan under the ppp and also claim a tax credit. Schedule a worksheet instructions. Ppp forgiveness works differently for sole proprietors and independent contractors the biggest difference being the concept of owner compensation replacement which greatly simplifies the loan forgiveness process. If the employer s employment tax deposits are not sufficient to cover the credit the employer may receive an advance payment from the irs by submitting form 7200 to request an advance payment of employer.

Section 1106 of the cares act addresses loan forgiveness and the sba has provided a small amount of additional guidance. This article will outline in a question and answer format how the loan forgiveness appears to work based on the information that is currently available. The paycheck protection program ppp is a loan designed for employers to keep their employees working. Applying for ppp loan forgiveness forgiveness forms 11 pages breaks into five pieces.

1 and 2 must be submitted to lender. By following these ppp forgiveness requirements business owners can move forward without having to repay all or at least some of the loan. Here s everything you need to know. The potential for complete loan forgiveness is one of the most appealing parts of how the ppp loan works.

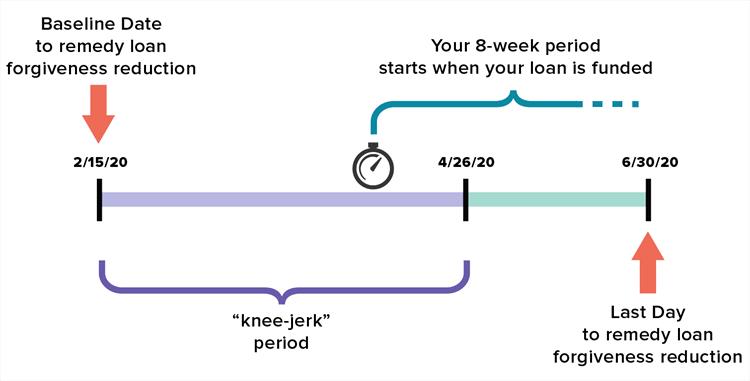

If you were assigned a ppp loan number on or before june 5 2020 you now have the option of taking 24 weeks to spend the funds instead of eight weeks. No more than 25 of the loan is used for non payroll costs including rent mortgage interest and business utilities. Many businesses who have been accepted into the ppp are beginning to receive lender disbursements thus starting the 8 week period that could qualify for forgiveness.